I admit I’m addicted to scrolling through social media and commenting occasionally. You’ll never know how many comments I’ve deleted before posting, but it felt good to release what I wanted to say. I’ve never regretted deleting them either. Recently I was very surprised by an online comment to me about how Boomers could never understand the struggles of a young family in trying to buy a home and make ends meet.

Excuse me! You think Boomers never struggled? Maybe this person will never understand how much we struggled in the beginning. What we have now didn’t come easy but took a lot of work, effort, and time. Hubby and I had to scrimp, save, do without, and make do when we were first married. We even had credit card debt for a while. Every time we paid it off, a car or truck or tractor would break down, and we’d have to charge repairs. We sometimes left just a little bit of debt on the card because if we paid it off, something would break. Guaranteed. There were days when we wondered if we’d ever come out of credit card debt.

We live in a nice house now, but we started out in a two-bedroom apartment. About six months into our marriage, we bought a used 14×54, two-bedroom, 1 bath mobile home in a park. Our first purchase was a sofa that was too big to get through the door. We had to cut the rear legs off of it to get it through. Until the day we sold it a couple of decades later, that sofa had 2×4 blocks under the back of it. We had both of our children while living in that mobile home. Let me tell you, it got crowded. We slept on the sofa (hide-a-bed) for years because we could afford the propane to heat the back bedroom where the temperature was quite a bit colder than the front where our little wood stove sat. We slept in back in the summer when it was warm. Our daughter got the tiny bedroom after she graduated from a crib to a bed because her brother needed the crib in the living room.

When the opportunity to buy land came, we cashed in my retirement fund to afford it. Loans from family allowed us to keep it. Those were the days of 12% to 16% mortgages. Our pitiful salaries couldn’t cover what the payments would be, but parents helped us. We used our meager savings to put in a well and septic system and moved our mobile home out there so we could save lot rent. It was an odd feeling to look out the same windows and see different scenery.

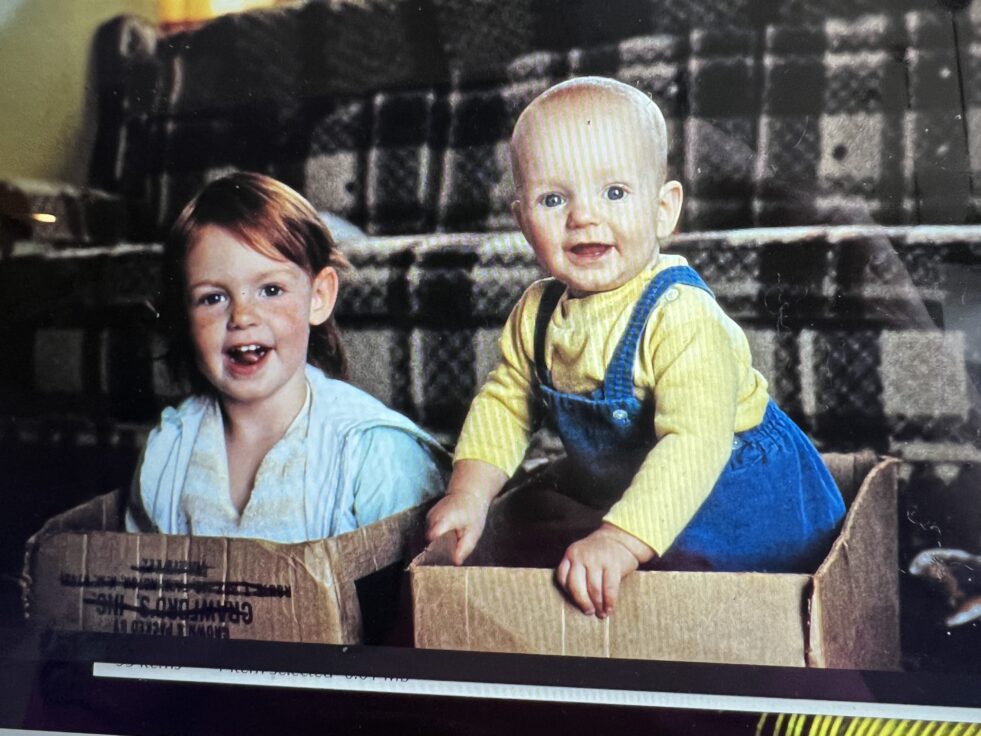

Hubby’s wonderful parents knew our crowded home predicament and our dreams of building a house. They gave us a loan at 10% (quite a bargain in those days) to build one. They made us sign loan papers and registered them with the County Clerk just in case we defaulted on our loan. Loaning and receiving money were very serious business to them, and I thank them for that lesson. We built our 3-bedroom, 2-bath house with the help of craftsmen we knew and friends. It was tough times, especially with our infant son and toddler daughter. Hubby and I would work until the middle of the night, sleep for a few hours, then he’d go to work and leave me a list of things I could do before he got home. It was very tough, but we succeeded. It was our first house.

As the years went by, Hubby’s salary got higher, and things got easier. Money was always tight, but we managed. We watched how we spent money and made financial plans for the future. I eventually went to work to help make up for lost time in saving for retirement and even paid back the retirement funds borrowed to buy the land. The only reason we live comfortably is because we still do those things: watch what we spend money on and make financial plans. I occasionally spring for that $6 chai latte and on special occasions get my nails done. Sometimes you have to treat yourself.

I know we’re not the only Boomers who struggled with young families. Your stories are as important as mine. I know lots of our peers who struggled as much as we did, yet over time, they came out ahead too. We kept plugging away, past all the doubts and fears, and it all worked out in the end.

Times are different now, and things are way more expensive. As those who went through our own tough times, maybe we should reach out and help young families who are going through them. Financial literacy is an important skill to have and to teach to your children. Having a college education is great, but blue-collar workers often make much more than college graduates. Encourage going to vo-tech schools for those who can’t afford college. College can come later, says this lady who was 36 years old when she became a college graduate. You do what you have to do to get by.